Your lender should always try to do the same. If trying to make particular point, of which your lender may disagree, avoid being argumentative. Listen to what your lender has to say and answer questions in clear and concise terms. ‘ Be prepared’ by having notes, spreadsheets, or other written facts in front of you if needed. So, what needs to be done verbally? Similar to writing, you need to able to get your point across effectively. If you are not, you may not get that follow-up phone call with a chance to express yourself verbally. Be effective in your written communication. But if you are typing a business correspondence, I would not recommend this tactic. If it is written correspondence, is the sentence structure in line? Are words spelled correctly? Do you type in all caps, all lower case or is everything handwritten? Are you able to communicate your thoughts in an organized fashion to where the reader knows exactly what you are trying to convey? We are all aware abbreviations and shortcut writing has become the norm in social media and texting. Your lender will be evaluating you from that first email or phone call. This applies not only to you as the borrower, but also to your lender, be it a banker or term lender. These will not all apply directly to your loan application process, but some will. That is a good thing, as we all want to make a good first impression. You are probably asking, “how does this apply to me and the loan I’m applying for?” Rather you realize it or not, you are accomplishing many of these points each and every day without really thinking about it.

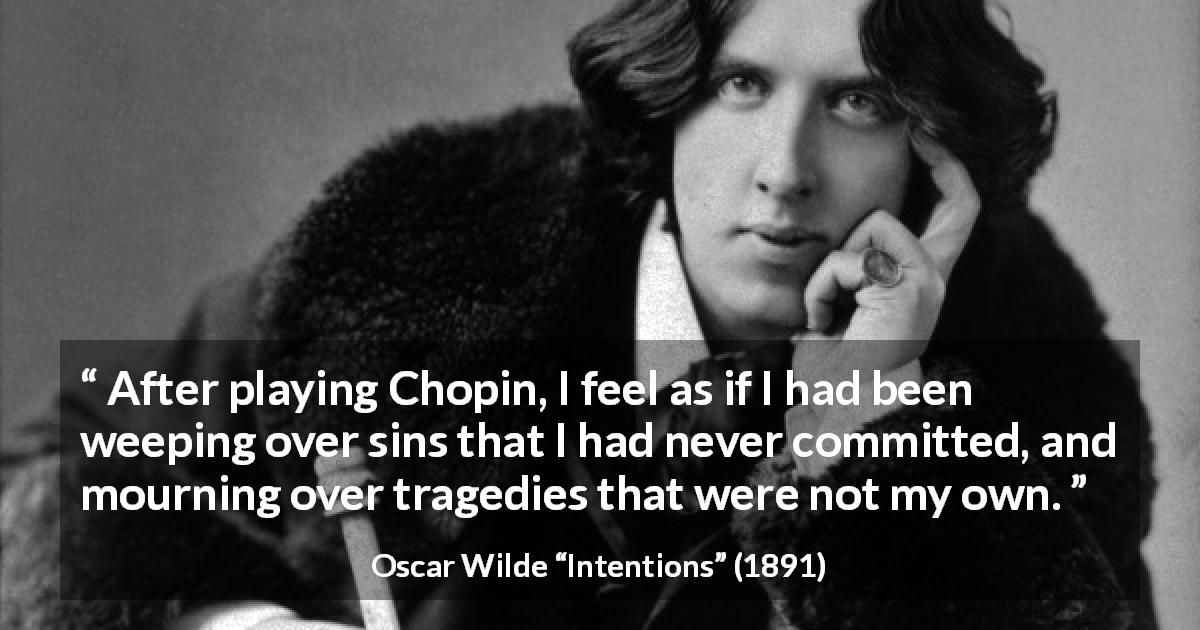

I realize these are likely more for someone applying for a job. Studies show a person will form their first impression somewhere between seven seconds and two minutes.Ī few ways mentioned to achieve this are: You have all heard the expression “You Never Get a Second Change to Make a First Impression.” It has been attributed to Oscar Wilde and Will Rogers, although nobody really knows for sure.

0 kommentar(er)

0 kommentar(er)